Bank and Customer relationship

Here are the Bank and customer relationship. How Bank customer relationship management is performed.

Bank

The bank is defined as “Accepting for the purpose of lending or investment of deposit, of money from the customers and repayable to customers on-demand or otherwise and withdraws money by checks, drafts order or otherwise.

Customer

A customer is a person who maintains a regular account with the bank, without taking into the consideration of the duration and operation from the account.

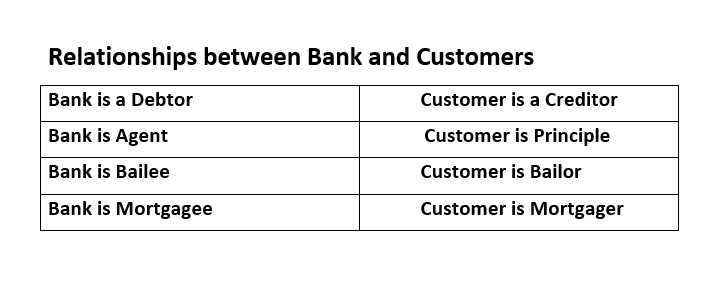

- A bank is a Debtor because it debits the account of the customer when the customer withdraws money.

- The customer is creditor because he deposits money in the bank. The bank gets money and the bank becomes a creditor.

- The bank is Agent because it collects payments, salaries, pensions, bills etc… and does clearing of checks from the customers.

- The customer is a principle because he is the real source of cash or deposits amounts.

- The bank is Bailee because it gives advice to the customer, tells them schemes and other services.

- The customer is a Bailor because he gets those services and advises and takes part in those schemes.

- The bank is a Mortgagee because it does the financing of the customer’s house and provides funds.

- The customer is a mortgagor because he is the one who mortgaged its house from the bank.

Duties and Rights of Bank and Customer

Here are some duties and rights of bank and customer, which they need to opt to maintain the relationship.

Duties of Banks

A bank should honor the check of the customer which is properly drawn. A bank should follow the standing instructions of the customer. Secrecy of the customer account balance and other information. Except in some cases like

- If the Bank require as evidence in the court.

- When emergencies in the country.

- When the customer himself says to tell someone.

Rights of Bank

- Charge interest and Commission for the services

Bank has the right to charge the interest on loans and other services. He has the right to charge commission and other fees related to transactions and regular maintenance of the account and other services.

- Bank can sale securities and shares

Ban has a right to sell the shares which submitted as security against the loan if loan defaults. Banks can also sell other securities to recover its loans.

Duties of Customer

- Customers should go to Bank at banking or working hours.

- Customer should present the check and other instruments at due dates

- Customers should ensure that its checkbook, ATM cards, and PIN are secured. He should keep its checkbook safe. If its checkbook leaf is missing or stolen, He should immediately report to Bank.

- The customer should fill the check thoroughly and duly with proper signs .amount in number and in words should match, the date should be correct availability of Balance.

Rights of Customer

- The customer has a right to withdraw money according to its balance or overdraft limit assign to the customer.

- The customer has a right to see its Bank’s account statement. He can get its account statement when he needs

- Customers can sue the Bank to court if the Bank fails to keep the secrecy of its account.

- Customers can sue the Bank to court if Bank dishonors the check without any error.

Relationship/Contract Termination between Bank and Customer

Bank and customer can terminate their relationship on following bases

- If the customer transfers its account to another branch or bank because he is not happy with the services provided to him.

- Unless customer’s locations changed

- If the customer’s job changed

- In case of death of the customer

- If insanity occur between bank and customer

If you have any queries or question you can comment or contact us. We will appreciate your opinion.

Read More;

What are Non-Banking Financial Institutions (NBFIs) ? Commonly known NBFIs

Types of Insurance | 7 Types of insurance companies